Institutional vs retail brokers

With over 3,000 securities firms operating globally, brokers play an important role in connecting clients to financial markets. They generally fall into one of two groups: retail brokers or institutional brokers. Although they both facilitate commerce, they serve completely distinct clients and have particular needs. Let’s see the differences between these two types of brokers.

Institutional brokers

Institutional brokers serve large organizations such as banks, pension funds, insurance companies, and mutual funds (1). They act as go-betweens, executing trades on behalf of these institutions in various financial instruments, including stocks, bonds, and other investment products (3). Institutional brokers leverage their expertise, market knowledge, and connections to secure the best prices and ensure effective transactions for their clients (3). They typically handle substantial sums of money and offer a range of services, including research, trade execution, and personalized client support (4).

Retail brokers

Retail brokers, in contrast, work with individual investors, providing them with access to financial markets (5). They facilitate equity and debt trades, enabling clients to buy and sell stocks and bonds (6). Retail brokers may also offer other financial products and services, such as mutual funds, options, retirement accounts, and financial planning advice (6). They are often referred to as stockbrokers or registered representatives (5). A primary goal of retail brokers is to acquire clients and execute trades to generate revenue for their firm (8). This focus on revenue generation can influence the services offered and the way retail brokers interact with their clients, as they aim to increase trading activity and generate commissions.

Types of Brokerage

Brokerage firms can be categorized into different types based on their service offerings and target clients:

- Online Brokerage: These firms primarily operate through online platforms, providing investors with a convenient and cost-effective way to access financial markets and execute trades (9). Online brokers often offer a wide range of investment products and tools, serving both individual and institutional investors.

- Discount Brokerage: Discount brokers offer lower commission rates and fewer services compared to full-service brokers (9). They primarily focus on trade execution, providing a basic level of service for investors who prefer to manage their own investments.

- Full-Service Brokerage: Full-service brokers provide a comprehensive range of services, including financial planning, investment advice, and portfolio management (9). They work with investors who seek personalized guidance and support in managing their investments.

These different types of brokerage firms address diverse investor needs and preferences, offering varying levels of service and cost structures.

Number of Institutional Brokers Worldwide

Determining the precise number of institutional brokers operating globally presents challenges due to the lack of centralized data and varying definitions across jurisdictions. However, some industry data provides valuable insights.

The Institutional Brokers’ Estimate System (I/B/E/S) database, a widely used resource for financial data, covers over 40,000 companies in 70 markets and is supported by more than 900 contributing firms, including institutional brokers 10. This suggests a significant number of institutional brokers operating globally, although it doesn’t provide an exact count 10.

In the United States, the Financial Industry Regulatory Authority (FINRA) reported a decline in the number of brokerage firms, with 3,378 operating at the end of 2022 (11). While this data doesn’t exclusively represent institutional brokers, it reflects a broader trend in the brokerage industry.

Furthermore, the e-brokerage market, which includes both institutional and retail brokers operating on online platforms, is projected to grow significantly. The market is expected to reach USD 32.0 billion by 2033, with a compound annual growth rate (CAGR) of 9.0% from 2024 to 2033 (12). This growth reflects the increasing use of online platforms by both institutional and retail investors for trading and investment management.

Number of Retail Brokers Worldwide

Estimating the number of retail brokers worldwide also poses challenges due to the fragmented nature of the market and the lack of comprehensive global data. However, various sources offer valuable information.

Forbes reports over 100 million brokerage accounts holding more than $20 trillion in retail client assets (13). This indicates a substantial number of retail brokers serving these accounts.

Another source suggests approximately 150 million online stock brokerage accounts globally, with 10-15% actively engaged in day trading (14). This implies a considerable number of retail brokers supporting online trading activity.

The Global Investment Banking & Brokerage industry, which encompasses various types of financial institutions, including retail brokerages, comprises 21,772 businesses worldwide in 2023 (15). This figure provides a broader context for the number of retail brokers, as it includes a wider range of firms involved in financial services.

Several initiatives aim to improve the trading experience for retail investors. The NYSE Retail Liquidity Program (RLP) and Cboe Retail Priority offer retail brokers opportunities to receive price improvement on retail orders, enhancing execution quality for individual investors 16.

Some exchanges also directly identify retail investors through personal information provided during account opening (16). This direct identification helps exchanges track retail investor activity, understand their needs, and tailor services accordingly.

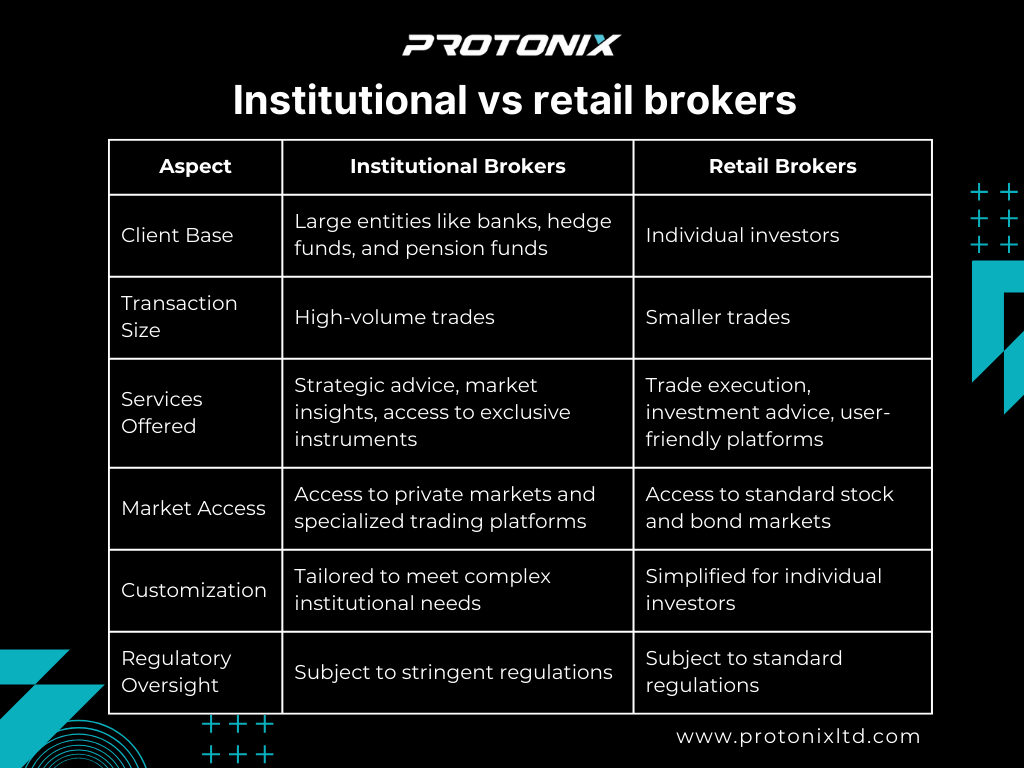

Comparing Institutional and Retail Brokers

While precise numbers are hard to attain, it’s evident that the retail brokerage market significantly surpasses the institutional brokerage market in terms of the number of clients and accounts (10). This disparity stems from the nature of their respective clientele. Institutional investors are large organizations with substantial investment portfolios, while retail investors comprise a vast number of individuals with varying investment needs and capital.

The services offered by institutional and retail brokers also differ. Institutional brokers focus on providing specialized expertise, in-depth research, and tailored solutions for their institutional clients. Retail brokers, on the other hand, serve a broader range of investors, offering services from basic trade execution to financial planning and retirement advice.

Key differences between institutional and retail traders further contribute to the distinction between the two types of brokers (17). Institutional traders typically trade larger volumes, have access to more complex financial products, and often employ sophisticated trading strategies. Retail traders, on the other hand, generally trade smaller volumes and may have more limited access to complex products and strategies.

Impact of Technology and Regulatory Changes

Technology and regulatory changes have significantly impacted the brokerage industry, transforming how brokers operate and interact with clients.

The rise of online trading platforms has revolutionized retail brokerage, providing individual investors with direct access to financial markets and enabling them to execute trades with greater ease and lower costs. This has increased competition in the retail brokerage market, with new online brokers emerging and challenging traditional firms.

Technology has also influenced institutional brokerage, with the development of sophisticated trading algorithms, risk management tools, and electronic communication networks (ECNs). These advancements have improved effectiveness and transparency in institutional trading, while also increasing the speed and complexity of transactions.

Regulatory changes, such as the Markets in Financial Instruments Directive (MiFID) in Europe and the Dodd-Frank Act in the United States, have introduced new rules and requirements for brokers, aiming to enhance investor protection and market integrity. These regulations have impacted various aspects of brokerage operations, including client onboarding, trade execution, and reporting obligations.

Conclusion

Anyone trying to make their way through the financial sector must be familiar with the distinction between retail brokers and institutional brokers. While retail brokers cater to individual investors, institutional brokers assist huge organisations with complicated and specific demands. Both are essential in making sure that all investors have access to the resources they need.

Works cited:

1. www.lsd.law, accessed on December 12, 2024, https://www.lsd.law/define/institutional-broker#:~:text=An%20institutional%20broker%20is%20a,get%20paid%20for%20their%20services.

2. Institutional broker Definition – Nasdaq, accessed on December 12, 2024, https://www.nasdaq.com/glossary/i/institutional-broker

3. institutional broker definition · LSData – LSD.Law, accessed on December 12, 2024, https://www.lsd.law/define/institutional-broker

4. What is Institutional Broking – Deposits.org, accessed on December 12, 2024, https://www.deposits.org/dictionary/term/institutional-broking/

5. Retail Broker » Wholesale Grocery, Pharmacy & Convenience Distributors, accessed on December 12, 2024, https://mrcheckout.net/retail-broker/

6. mrcheckout.net, accessed on December 12, 2024, https://mrcheckout.net/retail-broker/#:~:text=Retail%20brokers%20normally%20facilitate%20equity,and%20real%20estate%20investment%20trusts.

7. What Is a Retail Broker? – Work – Chron.com, accessed on December 12, 2024, https://work.chron.com/retail-broker-10315.html

8. Retail Broker Business Model – spintwig, accessed on December 12, 2024, https://spintwig.com/retail-broker-business-model/

9. Brokerage – Overview, Functions, and Specializations – Corporate Finance Institute, accessed on December 12, 2024, https://corporatefinanceinstitute.com/resources/commercial-lending/brokerage/

10. Institutional Brokers’ Estimate System – Wikipedia, accessed on December 12, 2024, https://en.wikipedia.org/wiki/Institutional_Brokers%27_Estimate_System

11. FINRA releases 2023 industry snapshot, accessed on December 12, 2024, https://www.regcompliancewatch.com/finra-releases-2023-industry-snapshot/

12. E-brokerage Market Size, Share, Growth | CAGR of 9.0%, accessed on December 12, 2024, https://market.us/report/e-brokerage-market/

13. State Of Retail Trading: The Evolving Retail Trading Landscape – Forbes, accessed on December 12, 2024, https://www.forbes.com/councils/forbesbusinesscouncil/2024/01/30/state-of-retail-trading-the-evolving-retail-trading-landscape/

14. Number of retail traders worldwide : r/Daytrading – Reddit, accessed on December 12, 2024, https://www.reddit.com/r/Daytrading/comments/10aufvb/number_of_retail_traders_worldwide/

15. Global Investment Banking & Brokerage – Market Research Report …, accessed on December 12, 2024, https://www.ibisworld.com/global/market-research-reports/global-investment-banking-brokerage-industry/

16. Retail trading: an analysis of global trends and drivers, accessed on December 12, 2024, https://www.world-exchanges.org/storage/app/media/WFE-Retail-Investment%20Sep%2020%202022.pdf

17. Institutional Traders vs. Retail Traders: What’s the Difference? – Investopedia, accessed on December 12, 2024, https://www.investopedia.com/articles/active-trading/030515/what-difference-between-institutional-traders-and-retail-traders.asp

18. The Biggest Stock Brokerage Firms in the US – Investopedia, accessed on December 12, 2024, https://www.investopedia.com/articles/professionals/110415/biggest-stock-brokerage-firms-us.asp

19. 9 Largest Brokerage Firms in the U.S. – Benzinga, accessed on December 12, 2024, https://www.benzinga.com/money/largest-brokerage-firms-in-the-u-s

20. BoA, Goldman and JP Morgan Top Cash Equity Brokers – Traders Magazine, accessed on December 12, 2024, https://www.tradersmagazine.com/departments/brokerage/boa-goldman-and-jp-morgan-top-cash-equity-brokers/

21. Online Brokerage Market – Share, Trends – Industry Analysis – Mordor Intelligence, accessed on December 12, 2024, https://www.mordorintelligence.com/industry-reports/global-e-brokerages-market23. Meet this year’s Top Retail Brokers in America, accessed on December 12, 2024, https://www.insurancebusinessmag.com/us/news/breaking-news/meet-this-years-top-retail-brokers-in-america-499520.aspx