Everything a Brokerage CEO Needs to Know about Payment Service Providers

Brokerage payments have changed. What was once a simple process is now complex, driven by online trading and global markets. To succeed, brokerage CEOs must understand Payment Service Providers (PSPs) and Alternative Payment Methods (APMs). These aren’t just add-ons; they’re fundamental to attracting clients, controlling costs, and improving operations. This guide explains PSPs, giving you the knowledge to improve your payment systems.

What is a PSP (payment service provider)?

A Payment Service Provider (PSP) is a third-party business that helps companies with electronic payments. They connect your business, customers, and multiple payment networks (such as credit card firms and banks). Instead of dealing directly with different financial institutions and payment systems, you can partner with a single PSP to manage the technical and regulatory struggle of transaction processing. A PSP manages the whole payment process, from the moment a customer initiates a payment until the time the funds are cleared in your brokerage’s account.

Let’s have a look at the range of services they offer.

Secure Payment Gateway: A secure online interface that captures and transmits payment information.

Transaction Processing: Handling the authorization, clearing, and settlement of payments.

Fraud Prevention: Implementing measures to detect and prevent fraudulent transactions.

Merchant Account Services: While some PSPs offer merchant accounts directly, others connect you to acquiring banks that provide them. (A merchant account is a special type of bank account that allows businesses to accept payments by credit card, debit card, and other electronic methods.)

Support for Multiple Payment Methods: Enabling acceptance of various payment options, including credit cards, debit cards, and, increasingly, alternative payment methods (APMs).

Reporting and analytics: It provides reporting on transactions.

What is PSP Payment?

A PSP payment is any payment made via a Payment Service Provider (PSP). It refers to a transaction in which a customer uses a payment mechanism (such as a credit or debit card) processed by the PSP your brokerage uses. The client’s payment information is sent via the PSP’s secure systems rather than directly to a bank or payment network. The PSP then handles the authorisation, clearing, and settlement of funds.

Let’s see some characteristics of a PSP payment:

- Security – PSPs are responsible for maintaining a secure environment for processing sensitive payment data. They must comply with industry standards like PCI DSS (Payment Card Industry Data Security Standard).

- Convenience – A PSP payment is typically seamless for the client. They choose their preferred payment method and enter their details.

- Efficiency – For the brokerage, PSP payments streamline the payment process, consolidating multiple payment methods into a single integration.

- Variety – PSP payments can encompass a wide range of payment types, depending on the PSP’s capabilities and the options your brokerage offers.

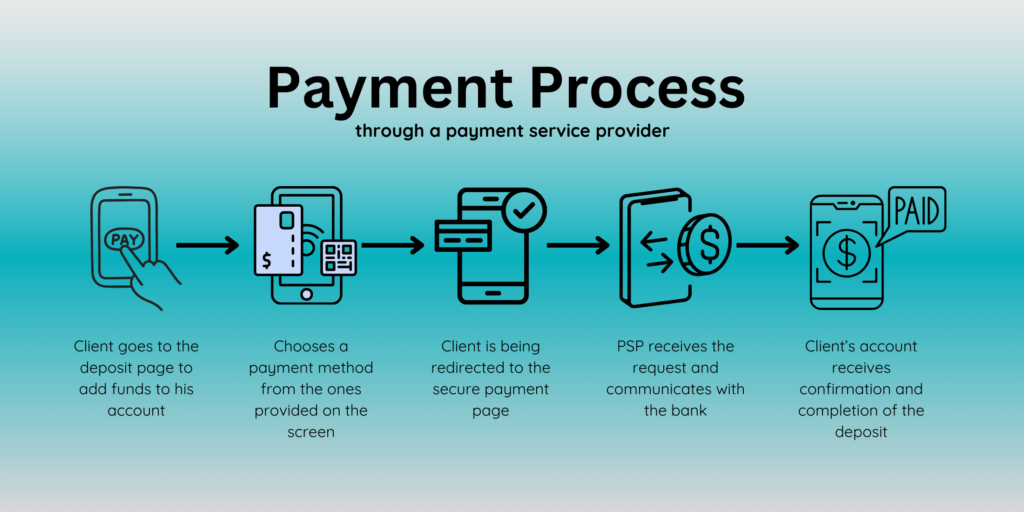

How do payment service providers work?

Payment Initiation: A client chooses to fund their trading account or make a payment on your brokerage platform and selects their preferred payment method (e.g., credit card, bank transfer, APM).

Secure Data Capture: The client enters their payment details on a secure payment page provided by the PSP. This page is often integrated directly into your brokerage’s website or app via an API (Application Programming Interface). The PSP encrypts the sensitive payment information to protect it during transmission.

Authorization Request: The PSP sends an authorization request to the client’s issuing bank or payment provider (e.g., the bank that issued their credit card). This request verifies that the client has sufficient funds or credit and that the payment method is valid.

Authorization Response: The issuing bank or payment provider sends an authorization response back to the PSP, either approving or declining the transaction.

Transaction Processing: If the transaction is authorized, the PSP facilitates the transfer of funds. This involves communication with various entities, including acquiring banks (which handle the merchant’s side of the transaction) and payment networks (like Visa, Mastercard, or alternative payment networks).

Settlement: The PSP ensures that the funds transfer from the client’s account to your brokerage’s merchant account (or the account designated by your PSP arrangement). The settlement time can vary depending on the payment method and the PSP’s agreements.

Reporting: The PSP provides your brokerage with detailed reports on transactions, including successful payments, declined payments, and any potential issues.

The PSP handles all the complex behind-the-scenes work of processing payments, allowing your brokerage to focus on its core business. They manage risk, security, and compliance while providing clients a smooth and convenient payment experience.

Payment Service Provider Business Model

Payment service providers (PSPs) generate revenue through various fees associated with processing transactions. There isn’t a single, universal business model; instead, PSPs often use a combination of the following approaches:

Transaction Fees – This is the most common revenue stream. PSPs charge a fee for each transaction processed. This fee can be:

–> Percentage-Based – A percentage of the transaction value (e.g., 2.9% + $0.30 per transaction). This is very common for credit card processing.

–> Fixed Fee – A set amount per transaction, regardless of the value (e.g., $0.50 per transaction). This might be more common for smaller transactions or specific payment methods.

–> Blended Rate – A combination of a percentage and a fixed fee.

–> Interchange Plus Plus (Pricing Model) – The cost includes the interchange fee (charged by card networks), scheme fee, plus the Payment provider’s markup.

–> Setup Fees – Some PSPs charge a one-time fee to set up an account and integrate their services.

–> Monthly Fees – A recurring fee for using the PSP’s services, regardless of transaction volume. This might be a flat fee or tiered based on features or processing volume.

–> Account Maintenance Fees – Fees that are related to keeping the account open.

PSPs may offer additional services for an extra fee, such as:

Advanced Fraud Prevention Tools: More sophisticated fraud detection and prevention systems.

Recurring Billing: Features for managing subscription payments.

Multi-Currency Processing: Supports accepting payments in multiple currencies.

Data Analytics and Reporting: More detailed reporting and analysis of transaction data.

Chargeback Management: Assistance with handling chargebacks (disputed transactions).

Hidden Fees: Although this shouldn’t be the case, some less transparent providers may have less apparent charges. Always check the fine print.

The specific pricing structure a PSP uses can vary significantly depending on certain factors.

The type of business: High-risk businesses (like online gambling or certain types of e-commerce) typically pay higher fees.

The transaction volume: Businesses with higher transaction volumes often negotiate lower rates.

The payment methods accepted: Different payment methods have different associated costs.

The geographic location: Fees can vary by region.

Brokerages must carefully compare the pricing models of different PSPs and choose the one that best aligns with their specific needs and transaction patterns. Transparency and clear communication about fees can save your brokerage significant time and money in the long run.

Integrating PSPs

Let’s go technical a bit and show you what it means.

Integrating a PSP usually involves connecting your brokerage’s systems to the PSP’s platform through an Application Programming Interface (API). This API acts as a communication bridge, allowing your system to send payment requests and receive responses from the PSP.

Some PSPs also offer Software Development Kits (SDKs) – essentially, pre-built code libraries – that can simplify the integration process for specific programming languages or platforms.

A key decision is whether to use a hosted payment page (where customers are redirected to the PSP’s site for payment) or a direct integration (where the payment form is embedded within your own site). Direct integration provides more control over the user experience but demands stricter adherence to security standards like PCI DSS.

Technical Integration:

API (Application Programming Interface): Most PSPs offer APIs to allow seamless integration with your existing platform. Choose a PSP with a well-documented and easy-to-use API.

SDKs (Software Development Kits): Some PSPs provide SDKs for specific programming languages or platforms which simplifies the integration process.

Hosted Payment Page vs. Direct Integration: Decide whether you want to use a PSP-hosted payment page (where clients are redirected to the PSP’s site to enter payment details) or a direct integration (where the payment form is embedded within your platform). Direct integration offers more control over the user experience but requires higher security compliance (PCI DSS).

Testing Environment: Ensure the PSP offers a sandbox or testing environment to thoroughly test the integration before going live.

Security and Compliance:

PCI DSS Compliance: Your system and the PSP must comply with PCI DSS to ensure secure handling of cardholder data.

Data Encryption: Verify that the PSP uses strong encryption to protect payment data.

Fraud Prevention: Choose a PSP with robust fraud prevention tools.

Supported Payment Methods:

Target Audience: Consider your target audience’s preferred payment methods. Offer various options, including credit cards, debit cards, and relevant alternative payment methods (APMs).

Geographic Coverage: If you have clients in different regions, ensure the PSP supports the popular payment methods.

Pricing and Fees:

Transparency: Carefully review the PSP’s pricing structure and ensure no hidden fees.

Transaction Costs: Compare the transaction fees, monthly fees, and other charges associated with different PSPs.

Contract Terms: Understand the contract terms, including minimum commitments or termination fees.

Reliability and Support:

Uptime: Choose a PSP with a proven reliability and high uptime track record. Payment processing downtime can lead to lost revenue and frustrated clients.

Customer Support: Ensure the PSP offers responsive and helpful customer support to assist with any technical or account-related issues.

Scalability: Choose a provider that can grow with your needs.

Reporting: A good provider offers detailed reports to help track sales and manage the business.

By carefully examining these aspects, you can choose a PSP that easily integrates with your brokerage, offers your customers a safe and simple payment experience, and promotes business development.

To this day, we’ve integrated more than 180 PSPs with our trading platform. If you’d like to see the full list of readily integrated PSPs, email sales@protonixltd.com, and we will be happy to share it. Or Book a meeting to see if we have everything you need.

Conclusion

If you operate an online brokerage, integrating with a payment service provider (PSP) is not just optional – it’s essential for doing business. The right PSP can significantly impact your ability to attract clients.

The shift towards digital payments is undeniable. A recent study by Statista shows that by 2025, the total transaction value of digital payments is projected to reach US$20.37tn. Given this projection, optimizing payment processing is essential for any online brokerage.