Cashier Update

Summary: Reduce fraud and risk, improve cash flow, and provide a better customer experience - all with just a few clicks. Learn more about how the new Cashier update can benefit your business in this article.

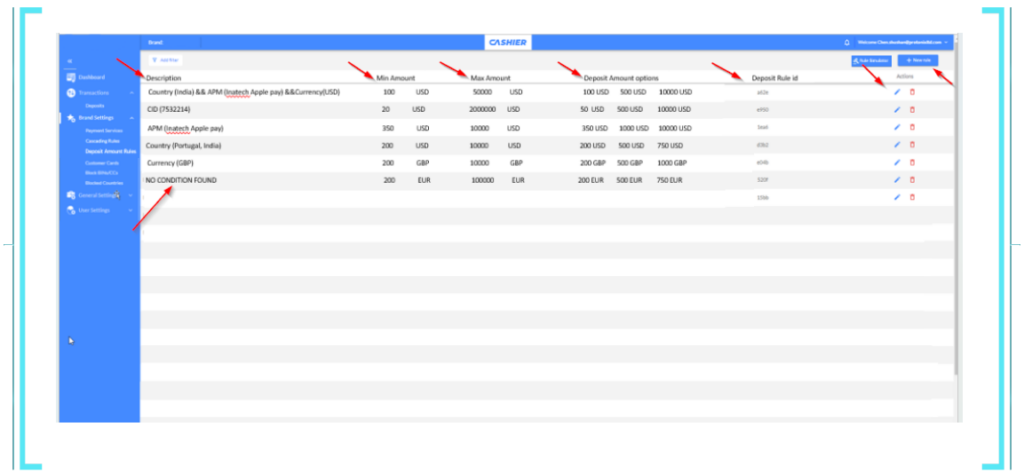

The new Cashier update gives you more flexibility to set deposit amounts based on your specific business needs. With this update, you can now set different deposit amounts for different APMs (payment methods), currencies, and countries. This can help you to reduce fraud and risk, improve your cash flow, and provide a better experience for your customers.

Why is it important to be able to set different deposit amounts for different APMs, currencies, and countries?

There are several reasons why:

- To reduce fraud and risk: Some APMs are more prone to fraud than others. For example, credit cards are more often used for fraudulent transactions than debit cards. By setting higher deposit amounts for high-risk APMs, you can make it more difficult for fraudsters to operate.

- To improve cash flow: By setting lower deposit amounts for popular APMs and currencies, you can encourage more people to deposit money into their accounts. This can help you to improve your cash flow and keep your business running smoothly.

- To provide a better customer experience: Customers will appreciate having the flexibility to choose the deposit amount that works best for them. This is especially important for customers who are depositing money from different countries.

- Compliance with regulations: Some countries have regulations in place that govern the amount of money that can be deposited into brokerage accounts. By setting deposit limits per country, brokerage owners can ensure that they are in compliance with all applicable regulations.

How can the new Cashier update help you to reduce fraud and risk?

For example, you can set a higher deposit amount for credit cards than for debit cards. This will make it more difficult for fraudsters to use stolen credit cards to deposit money into their accounts.

One other use of this new update is that you can use deposit limits to reduce the risk of fraud by preventing clients from depositing large amounts of money from countries with high rates of fraud.

Finally, you can use the new Cashier update to monitor deposit activity for suspicious patterns. This can help you to identify and prevent fraudulent transactions.

How can the new Cashier update help you to improve your cash flow?

On one hand, when the fixed part of the commission represents a relatively high percentage of low deposit amounts, you can set a higher minimum deposit for that specific APM. This strategic move ensures that you only pay commissions on transactions that are truly cost-effective for your business. For example, if you have an APM that imposes a significant fixed commission on transactions below $100, adjusting the minimum deposit for that APM can be a wise financial decision.

On the other hand, for APMs that charge a percentage-based commission, you can benefit by setting appropriate minimum deposit amounts. This way you can minimize the impact of percentage-based fees on smaller transactions, ultimately preserving more of your revenue.

In addition, the new Cashier update also allows you to set lower deposit amounts for popular APMs and currencies. This can encourage more people to deposit money into their accounts, which can help you to improve your cash flow. For example, you can set a lower deposit amount for debit cards and for popular currencies such as USD and EUR.

Overall, the new Cashier update is a valuable tool that can help you to improve your cash flow and save money on APM fees.

How can the new Cashier update help you to provide a better experience for your customers?

The new Cashier update allows you to give your customers the flexibility to choose the deposit amount that works best for them. This is especially important for customers who are depositing money from different countries. For example, you can set different deposit amounts for different countries based on the exchange rate.

Conclusion

The new Cashier update is a game-changer for businesses of all sizes. By empowering you to set different deposit amounts for different APMs, currencies, and countries, you can gain complete control over your financial operations.