Who’s Who in Finance? Brokers, Dealers, and Beyond – Part 2

In Part 1, we saw the diverse cast of characters that animate the financial world. From brokers connecting buyers and sellers to investment bankers raising capital for companies, each player has an important role. But the financial ecosystem doesn’t operate in siloes. Today, we dive into the broker-dealer world, a hybrid combining brokers and dealers.

The Hybrid: The Broker-Dealer

In the real world, many financial institutions operate as broker-dealers. Depending on the situation, they can act as both a broker and a dealer. For example, a broker-dealer might connect a client with another investor for a stock purchase (acting as a broker) or sell stocks from their own inventory if no matching buyer is readily available (acting as a dealer).

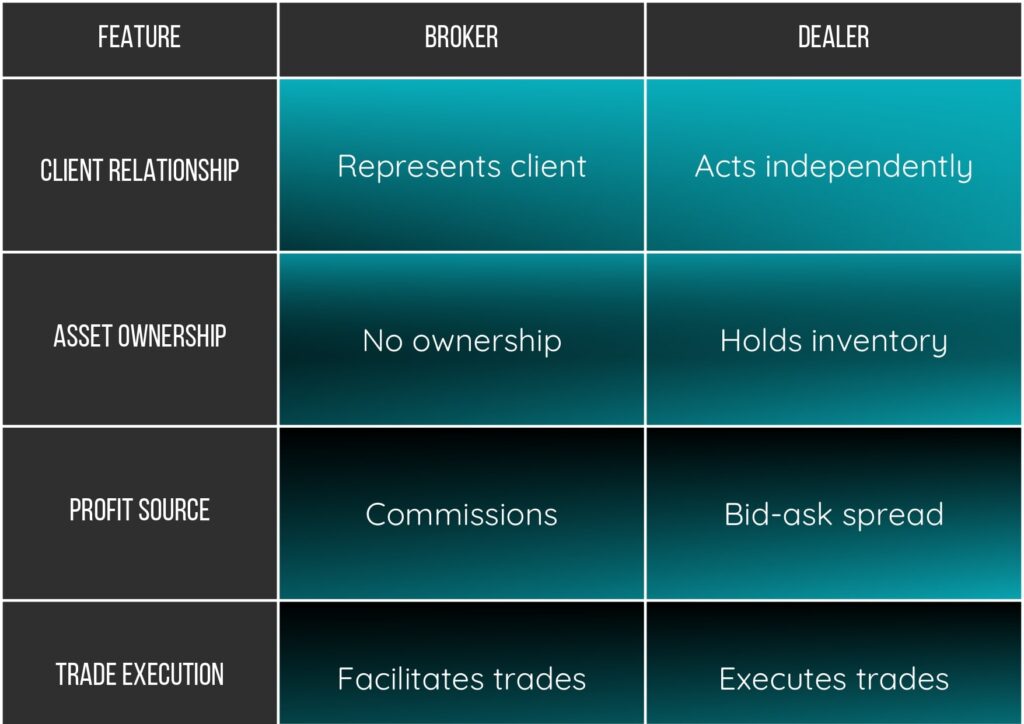

Key Differences:

Here’s a table summarizing the key differences between brokers and dealers:

Broker-Dealer Types:

Within the broker-dealer category, there are further distinctions:

- Wirehouse: Large, full-service financial institutions offering investment products, brokerage services, and financial planning.

- Introducing Broker-Dealer (IBD): A specialized broker-dealer that focuses on client acquisition and often partners with larger broker-dealers to execute trades.

How to become a Forex Dealer:

The path to becoming a forex dealer can vary depending on your location and desired career path. Here are some general steps to consider:

- Education and Training: Pursue a relevant degree in finance or economics. Consider additional certifications specific to forex trading.

- Gain Experience: Look for entry-level positions at forex brokerages or financial institutions with forex trading desks. This can help you develop practical skills and market knowledge.

- Licensing: Depending on your location and chosen role, you might need to obtain specific licenses or registrations to operate as a forex dealer.

The Cost of Starting a Broker-Dealer

Starting a broker-dealer requires significant financial investment and regulatory hurdles. Here’s a breakdown of some key expenses to consider:

- Registration Fees: The Securities and Exchange Commission (SEC) and Financial Industry Regulatory Authority (FINRA) charge registration fees for broker-dealers. These fees can vary depending on the specific licenses required.

- Minimum Net Capital: Broker-dealers are required to maintain a minimum net capital, which is a measure of their financial stability. According to this document, this amount can range from $50,000 to $250,000 or more, depending on the type of business and activities conducted.

- Compliance Costs: Maintaining compliance with regulations requires ongoing costs, including legal and accounting fees, as well as investments in technology and training programs.

- Technology and Infrastructure: Operating a broker-dealer necessitates robust technology infrastructure to handle trading activities, client communication, and data security. These costs can be significant.

It’s important to note that this is not an exhaustive list, and the total cost of starting a broker-dealer can vary considerably. Consulting with a financial professional specializing in securities regulations is highly recommended before embarking on this path.

Conclusion

Understanding the roles of brokers, dealers, investment bankers, financial advisors, portfolio managers, and traders, gives you a comprehensive view of the financial ecosystem. Each professional plays a vital part. They help the markets run smoothly and individuals and institutions achieve their financial goals. So, whether you’re a seasoned investor or just starting out, we hope we helped you get familiarized with these key players.