4 Essential Steps to Start a Forex Brokerage Business

Summary: Are you interested in starting a forex brokerage business? This article will walk you through the essential steps, from choosing the right business model to building a loyal client base. Read along to learn more!

The global contract for difference (CFD) market is thriving and it is expected to reach $7,647.60 million by 2030, expanding at a CAGR of 3.10% between 2023 and 2030. If you’re considering starting a forex brokerage, it’s essential to follow the proper steps and decisions to ensure success. This guide provides a step-by-step overview of the key considerations in creating a forex brokerage business, starting with defining your target location, what to look for when picking your technology provider and launching your brand.

Here are the key considerations involved in starting a forex brokerage business, broken down into 4 major parts:

1. Set up a business plan

The first step is to create a business plan that outlines your goals, strategies, and financial projections. This will help you to stay on track and make informed decisions throughout the business-building process.

Define your business model. Choosing the right business model is a critical step when opening a brokerage. There are two primary models to consider: ‘Book A’ and ‘Book B’.

In the ‘Book A’ model, also known as the Agency Model or No Dealing Desk (NDD), brokerages act as intermediaries, routing traders’ orders directly to the market. This model is favored for its transparency and market-driven pricing.

On the other hand, the ‘Book B’ model, often associated with Dealing Desk execution, means brokerages become the counterparty to traders’ orders. While some traders prefer this model for its additional services, it’s crucial to carefully evaluate the potential for conflicts of interest. The choice of model should align with your brokerage’s goals and values.

Will you be a self-service broker or a call center broker? A self-service broker offers a trading platform that clients can use to trade on their own. A call center broker offers a more hands-on approach, with dedicated account managers for each of their traders to assist them with resolving account issues, providing market insights and more.

Identify your target market. Who are you targeting with your brokerage? This could be retail traders, institutional investors, or a combination of both.

Carefully analyze the demographics, including age, gender, income levels, and geographical locations of your potential clients.

Tailor your services to align with their financial goals and preferences. Determine whether you’ll focus on beginners, intermediate traders, or professionals, as each group has distinct needs and expectations.

Assess the risk appetite of your target market – some clients might prefer low-risk investments, while others are comfortable with higher risk for potentially higher returns. Offer a range of investment options that align with varying risk tolerances.

Recognize the trading styles your clients are likely to adopt, such as day trading, swing trading, or long-term investing, and provide the necessary tools, analytics, and educational resources to support their preferences.

Research the regulatory requirements. What are the regulatory requirements in the jurisdictions where you plan to operate? Each jurisdiction has its own set of rules and regulations that forex brokers must comply with.

Comprehend the financial requirements and obligations tied to regulatory compliance. This includes minimum capital requirements and ongoing reporting standards.

Be aware of client fund protection measures. Some regulators mandate the segregation of client funds from operational funds to safeguard traders’ capital.

Stay informed about anti-money laundering (AML) and know-your-customer (KYC) procedures. Brokerages must implement robust AML and KYC protocols to prevent financial crimes and ensure client due diligence.

Be prepared to adhere to advertising and marketing regulations. These often dictate how brokerages can promote their services and what claims they can make to potential clients.

Develop a marketing plan. How will you reach your target market and generate leads? This could include things like search engine optimization, social media marketing, marketing campaigns and attending industry events.

To ensure your marketing strategy hits the mark, begin by understanding your target audience and tailoring your approach to resonate with them. Embrace the digital realm, leveraging channels like social media, SEO, and PPC advertising to extend your reach. Forge strategic partnerships and affiliates to expand your client base, all while closely monitoring performance with data analytics to make real-time adjustments.

Remember to maintain compliance with regulatory guidelines, allocate your budget wisely, and ensure consistency in branding and messaging.

Lastly, don’t overlook the power of customer feedback to refine your strategies and enhance the client experience. With these key considerations, your brokerage can thrive and stand out in the market.

Create a financial plan. How much money will you need to start and operate your brokerage? This will depend on a number of factors, such as the initial setup, technology, licensing fees, staff salaries, the marketing and advertising you plan to do.

2. Choose the right technology

The technology you choose will have a major impact on the success of your brokerage. You will need a trading platform that is reliable, user-friendly, and meets the needs of your target clients. You will also need a CRM system to manage your client relationships, a Cashier connected to payment processors to facilitate transactions, and a back office system to track your finances.

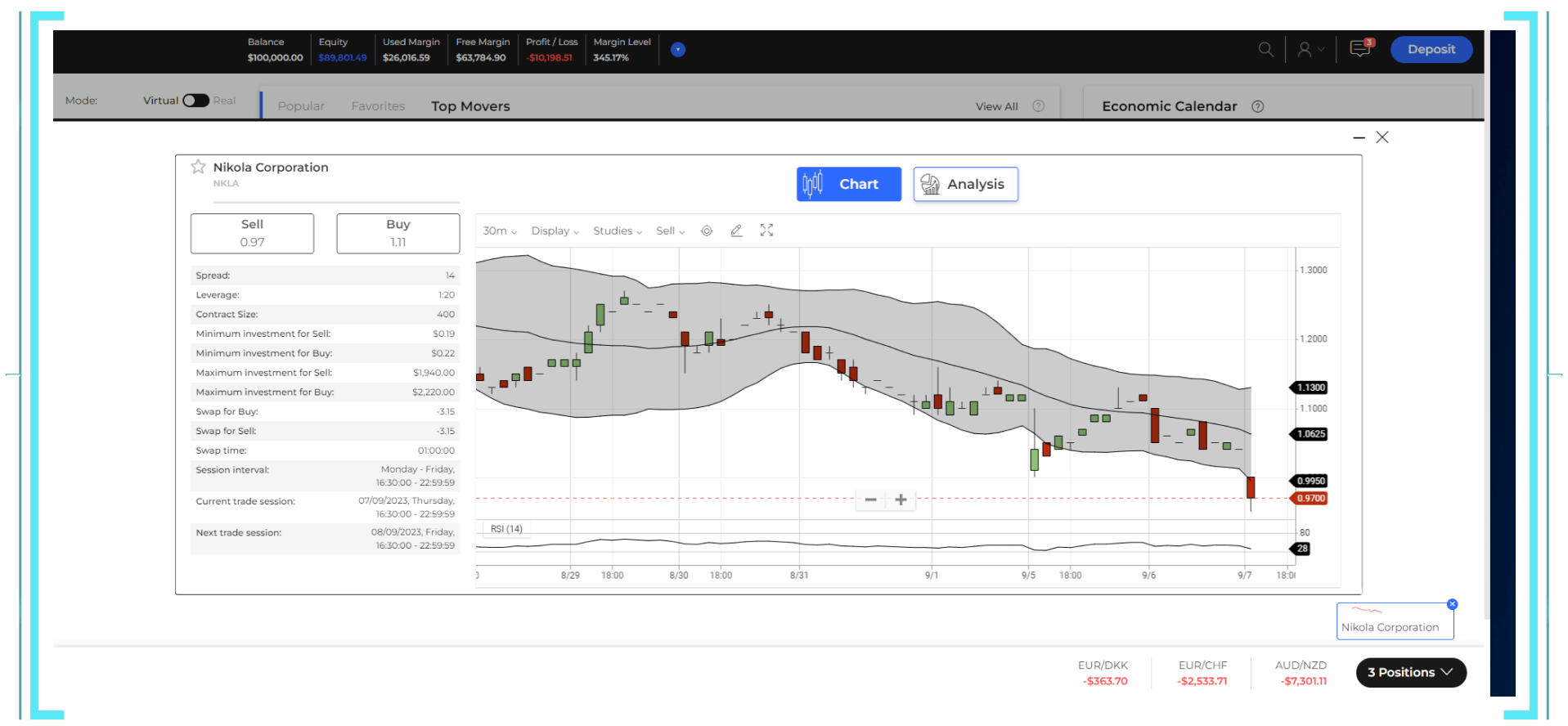

Choose a trading platform that is easy to use for your traders. It should offer the features and functionality that your clients need, such as charting tools, order execution, and market analysis.

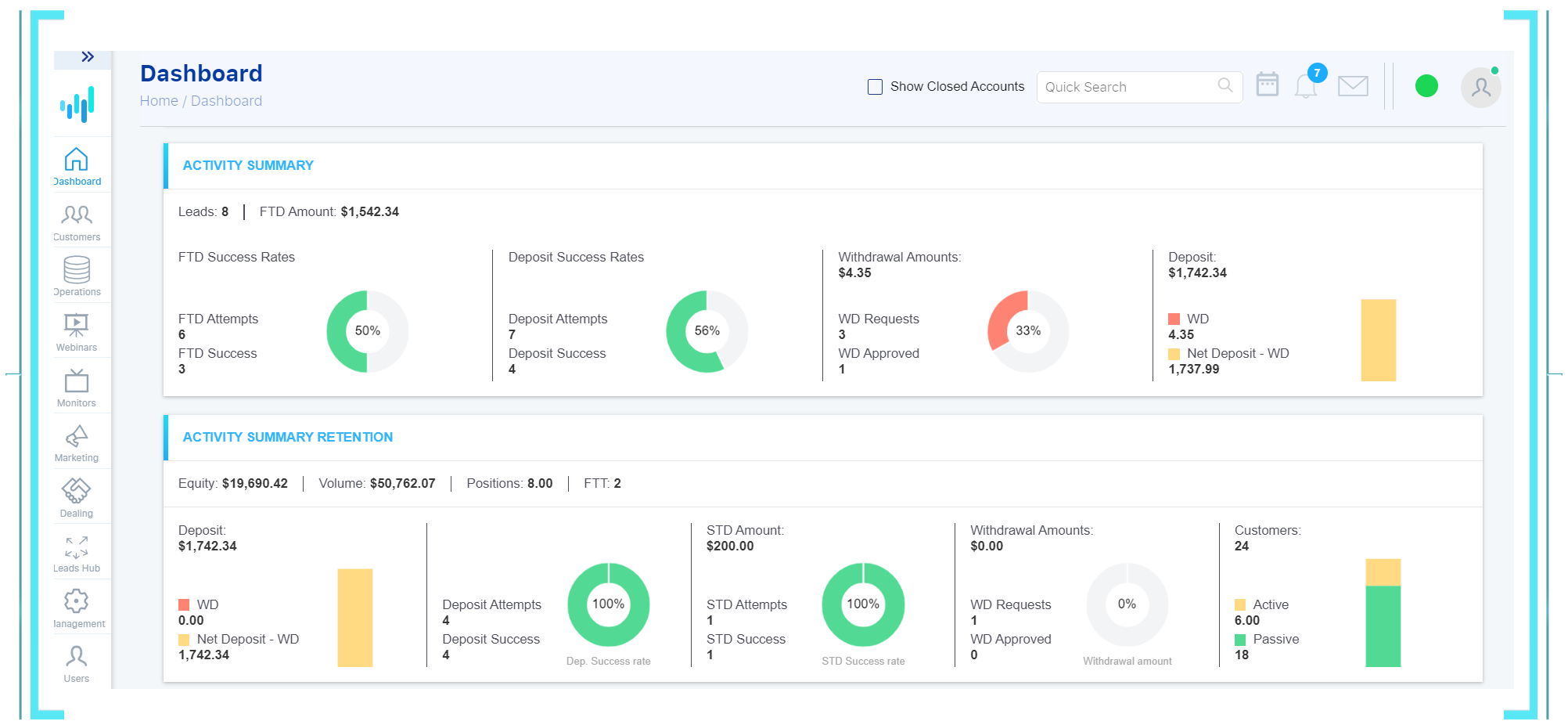

Invest in a CRM system to manage your client relationships. This will help you to stay organized and track your interactions with your clients. If your business mode is a call-center oriented one, then a CRM may be the most important part.

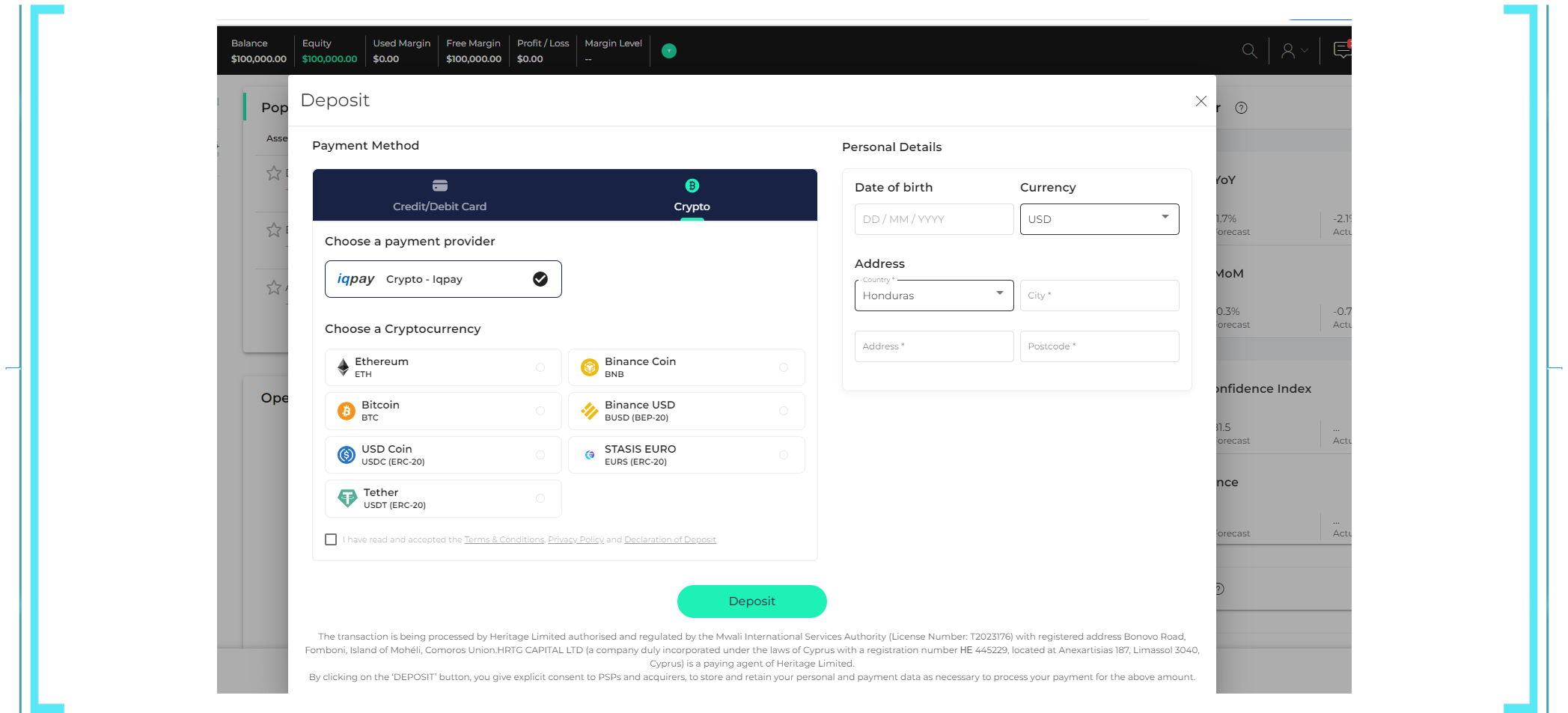

Choose a Cashier that is reliable and secure. This ensures that your clients can seamlessly make deposits and withdrawals while their sensitive financial information remains protected. Furthermore, offering a diverse array of Alternative Payment Methods (APMs) and Payment Service Providers (PSPs) is equally vital. This flexibility empowers your clients to transact using their preferred methods, enhancing their overall trading experience.

3. Obtain the necessary licenses and regulations

The regulatory requirements for forex brokers vary depending on the jurisdiction in which you operate. You will need to carefully research the requirements in your target market and obtain the necessary licenses and permits.

Choose the right jurisdiction to operate in. Some jurisdictions have more favorable regulatory requirements than others. For example, the European Union (EU) has a strict regulatory framework for forex brokers, with the Cyprus Securities and Exchange Commission (CySEC) being the most popular regulator. In the GCC countries, there is no single regulatory body for forex brokers, but some operate under offshore regulations, such as the Seychelles Financial Services Authority (FSA).

Apply for the necessary licenses and permits. This process can be time-consuming and expensive, so it is important to start early.

Comply with all regulatory requirements. This entails selecting a technology solution that can effectively support all regulatory requirements, including complex logic questionnaires.

4. Prepare to launch your brokerage

Once you’ve addressed the essential business and regulatory requirements, you can initiate the process of building your brokerage’s brand, implementing promotional strategies, and client onboarding.

Set up a website that is informative and easy to use. Your website should be the central hub for your brokerage, providing information about your services, trading conditions, and contact information.

Promote your brokerage through online and offline channels. Craft a comprehensive marketing strategy that leverages both digital and traditional channels to maximize your brokerage’s visibility and reach among potential traders.

Onboard clients and provide them with excellent customer service. By prioritizing stellar support, you not only retain satisfied clients but also fuel the growth of your brokerage. Building trust and offering a seamless experience keeps clients coming back and recommending your services to others, ultimately ensuring the prosperity of your business.

Conclusion:

Starting a forex brokerage requires careful planning and decision-making. By following the steps outlined in this guide and seeking assistance from a trusted technology provider, you can set up a successful forex brokerage business. Remember to prioritize factors such as target location, technology provider selection, trading platform choice, liquidity provision, CRM integration, and brand building to attract and retain clients in the competitive forex market.