3 automation ideas for forward-thinking CFD Brokers

Summary: Automation is a powerful tool that can help brokers save time and improve their operations. By handling rollovers, taking care of low margin levels before they happen, and sending personalised alerts to traders, automation can help brokers focus on growth.

2 min read

What’s one of the most important resources for forex or cfd brokers? Time!

And this is where automation comes in. It allows brokers to focus on what truly matters: growing their brokerage and offering excellent service to their clients. In this article, we’ll go through three of our platform’s features and show you how to win some time with automation.

Why managing time matters in brokerage operations

Brokers usually have a lot on their plates. Imagine them as jugglers who keep multiple balls in the air at once. Every day, they’re working with the sales team, figuring out rules, and staying in touch with tech providers. With so much going on, time isn’t just valuable; it’s a cup flowing over.

Automation steps in like a skilled assistant, taking over some of the routine tasks. This support allows brokers to keep the balls in the air a little longer.

When brokers use their time wisely, they can react better to market changes and meet their clients’ needs more effectively. Let’s see our 3 ideas that could help a cfd broker win back some time.

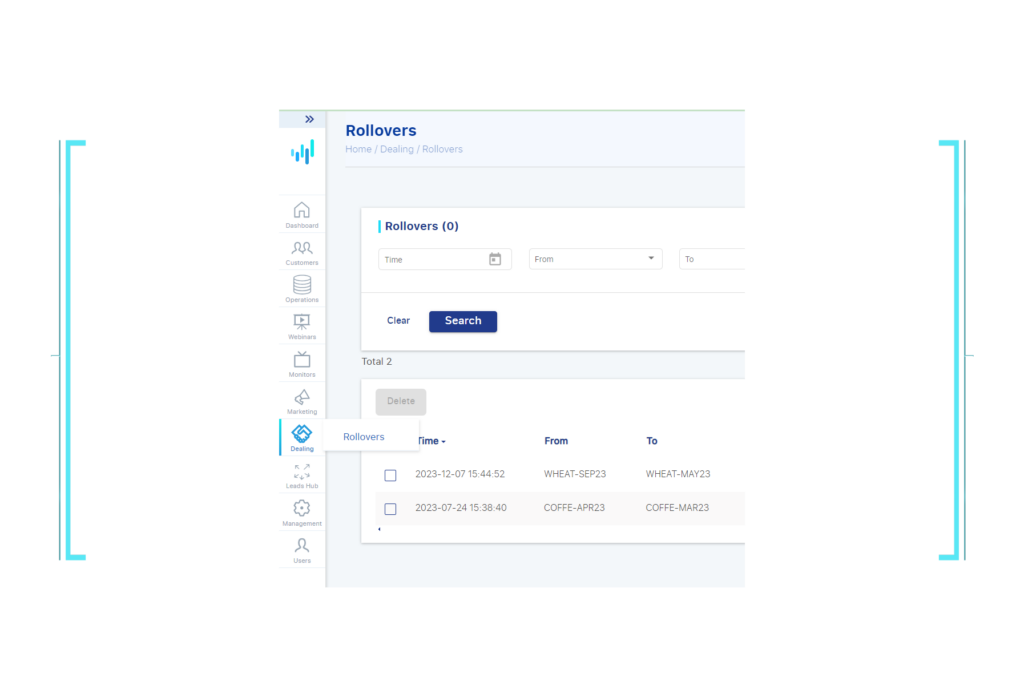

1. Automatic rollovers

Contracts about to expire can be a headache. They consume time and add manual effort.

As the expiration date approaches, the system automatically executes rollovers. Here’s how it works: clients receive emails notifying them about the event and a full report. The report shows the assets rolled over, old and new prices, and balance adjustments.

This process offers a smooth transparent transition and frees your dealing team allowing them to focus on other strategic decisions.

The Advantage?

Making rollovers automatic will free up your team to make important decisions instead of getting stuck on small jobs. Things will run more easily and mistakes will be less likely to happen.

2. Margin management

A good first step in effective trading is monitoring margin levels. With our automation, traders receive instant notifications if their equity dips below 80% of the required margin. This alert helps traders take necessary actions to maintain a safe margin. It lowers the risk of unexpected liquidations. Not only does this protect traders, but it also saves brokers the trouble of keeping an eye on everything all the time.

The Advantage?

By sending immediate alerts for low-margin levels, you work on building trust in your platform. This method helps traders by minimising their potential losses.

3. Price alerts with Solitics

One of our offered integrations is Solitics. Our partner takes automation to a whole new level. With Solitics, brokers can send their clients personalised price alerts. Imagine that you are a new trader who has just started dealing gold. With Solitics, they could get a personalised warning when the price of silver changes, making trading more interesting. This level of customisation keeps clients interested and in touch. It lets agents build strong relationships without having to keep an eye on them all the time.

The Advantage?

Using price alerts increases client engagement. It creates a more interactive trading environment. This closer connection can lead to more informed and profitable trading decisions.

Embracing automation is more than saving time. It’s about transforming your brokerage into a responsive, client-focused operation. Using these simple features already available in our platform, you simplify your processes and strengthen your position.

Unlock the potential of automation today and see how it can improve your brokerage efficiency.