Money Manager: Role, Comparison, Salary

Summary: Money managers don't just take care of your investments; they also come up with plans to help you reach your financial goals. Let's talk about what money managers do, how to become one, and the differences between the different types. Read along

3 min read

A money manager is a person or financial organisation who manages an individual or institutional investor’s portfolio.

Consider a money manager both a personal financial coach and an investment quarterback. They take the time to understand each individual’s economic status, risk tolerance, and goals. Based on this thorough study, they create a customised investment plan to manage the portfolio.

What does a money manager do?

Asset managers, portfolio managers, and investment managers are all names that refer to forex money managers.

- Forex fund managers conduct in-depth market research.

- They select and manage investments.

- They track performance.

- They adjust strategies as needed.

- They handle rebalancing portfolios to maintain an optimal asset allocation.

- They make sure the investments stay aligned with the set financial goals.

A key part of the money manager’s description is aligning investments with the set financial goals. They must inform clients of market changes and their impact on the portfolio.

Forex money managers are bound by a fiduciary duty, which means they have to put their client’s best interests first—no exceptions. It’s not just good practice, it’s the law. What does this mean? Well, they have to make sure their advice is based on the most accurate information out there, while also keeping costs in check. Plus, if there’s ever a potential conflict of interest, they’d have to be upfront about it. Unlike some managers who just give advice, forex fund managers directly handle investments, meaning they carry the full responsibility. And yes, they’re held to strict ethical standards to make sure they’re always doing right by the client.

Money managers perform a wide range of tasks, depending on the type of investments they manage. Let’s see the types of money managers.

Types of Money Managers

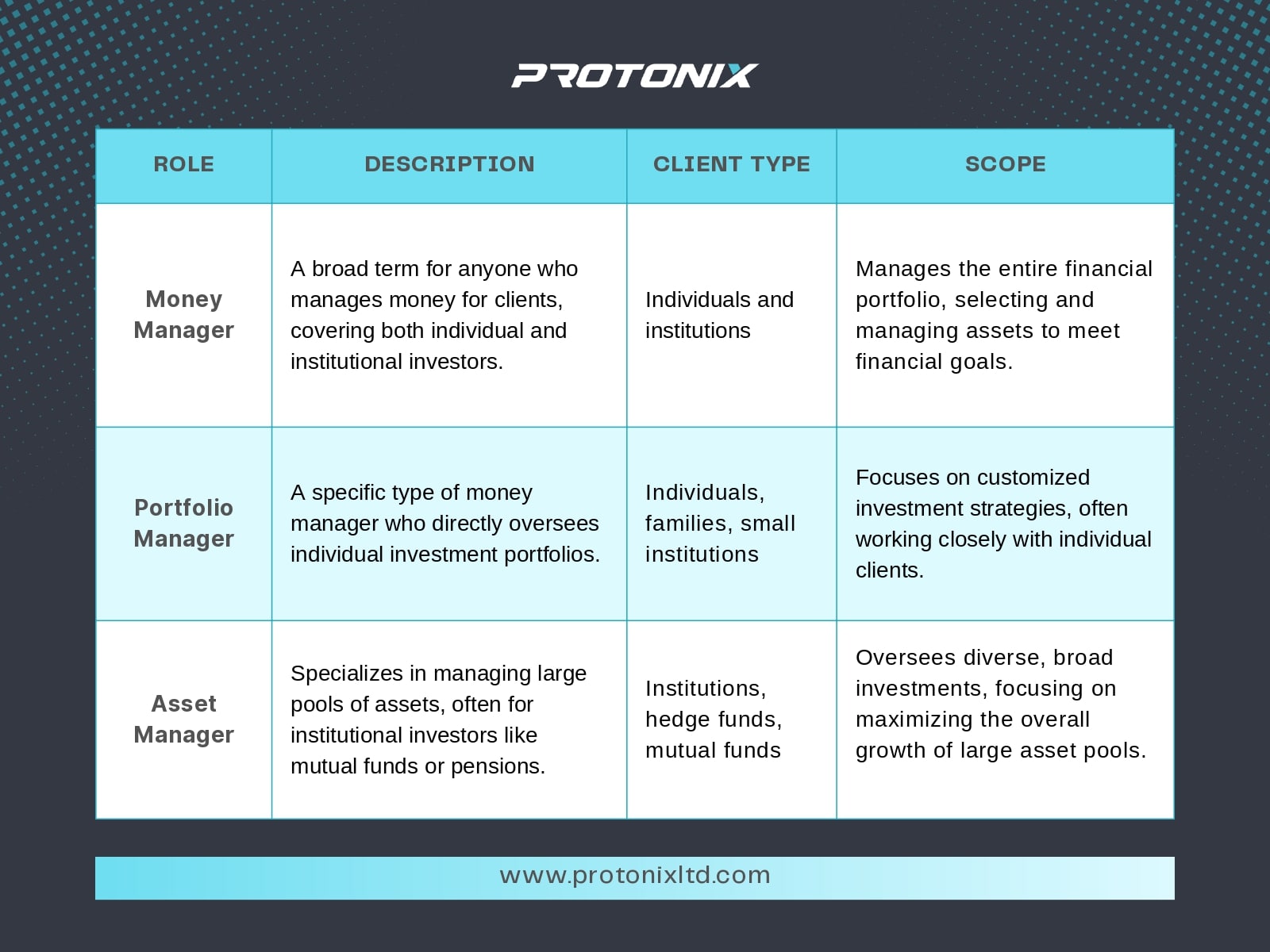

Asset manager vs portfolio manager

When comparing an asset manager vs a portfolio manager, there are some distinctions. Asset managers typically oversee large investment pools like mutual funds or hedge funds. In contrast, the portfolio manager function often involves managing individual or family investment accounts. While both roles involve investment management, their scope and focus can differ significantly. Portfolio managers may have a more personalised approach, tailoring strategies to specific client needs, whereas asset managers often work with broader, more diverse investment pools.

How to become a money manager

Wondering how to become a portfolio manager? A strong educational foundation is the first step. Aspiring money managers typically need a bachelor’s degree in business, economics, or a related field. Many professionals also work towards higher certifications, such as the Chartered Financial Analyst (CFA) title to further develop their skills.

A portfolio manager’ training often begins as an investment analyst. This way they gain practical experience through internships or entry-level positions. This kind of hands-on training is very important for getting the skills and information needed in this field.

There are many important skills that a portfolio manager needs to have. It is necessary to have strong logical skills, good speaking skills, the ability to think critically, and the ability to solve problems. A portfolio manager also needs to be good at financial modelling, risk management, and having a deep understanding of how markets work.

In this area, it’s also important to keep learning. Many people who want to be portfolio managers engage in ongoing portfolio manager training, going to workshops, and learning about the newest financial tools and trends.

Lastly, making connections in the business world can help you move up in your job. If you want to learn how to become a portfolio manager, going to industry conferences, joining professional groups, and looking for training opportunities can all help.

In light of the potentially substantial earnings, it should come as no surprise that many individuals are interested in learning how to become a money manager.

What is the money manager’s salary?

Money managers often charge an annual management fee equivalent to a percentage of a client’s portfolio. On average, advisers charge 1% to 2% of their customers’ assets under management. However, several factors influence the portfolio manager’s earnings. For example, fees on large accounts may be smaller so that single clients don’t end up paying exorbitant amounts.

Portfolio manager pay varies depending on their experience, where they work, the number of clients, and the size of their company. Indeed.com shares that the usual starting salary for a Money Manager is $115,000 a year. However, bonuses and performance-based compensation can significantly increase portfolio manager earnings.

It’s worth noting that with the increasing trend of remote work, many firms now offer portfolio manager remote positions, which may affect compensation structures. These remote opportunities can provide flexibility for money managers while potentially impacting their overall earnings package.

The money manager’s salary can vary based on these factors. But in the end, if you like what you do and you are good at it, this could be a very profitable job choice.

Conclusion

Whether you’re looking to become a money manager or hire one we hope we shed some light on their role, responsibilities, and earning potential. The role of money managers remains essential in helping individuals and institutions make informed investment decisions and secure their financial futures.